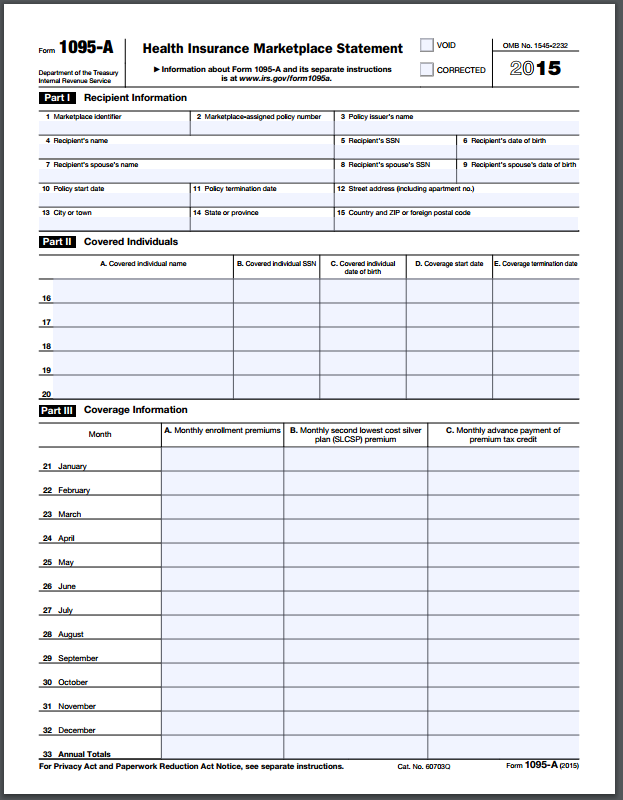

Jun 04, 19 · The form should be mailed to you by midFebruary If you have an online account at healthcaregov, you may be able to retrieve the form as a PDF file (portable document format) For other types of health insurance, such as employersponsored health insurance, you may receive a Form 1095B or 1095CThat comes to a total potential general ACA reporting penalty of $560 per employee when factoring in both the late/incorrect Form 1095C furnished to the employee and the late/incorrect copy of that Form 1095C filed with the IRS The maximum penalty for a calendar year will not exceed $3,392,000 for late/incorrect furnishing or filingMay 05, 17 · It's unclear whether the IRS has assessed any Affordable Care Act employer shared responsibility penalties to date, or penalties for failure to timely (and correctly) file 16 Form 1095C

Your 1095 C Tax Form For Human Resources

1095 c form 2021

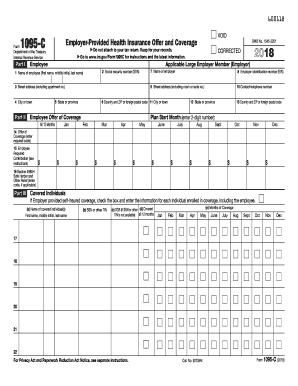

1095 c form 2021-With the COVID19 pandemic still forcing businesses to work from home, it's important to consider your distribution plan for 21Taxpayers should receive Affordable Care Act information statements from their employer (s) or coverage provider by early March in 21 regarding their health insurance coverage Form 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees

Form 1095 C Mailed On March 1 21 News Illinois State

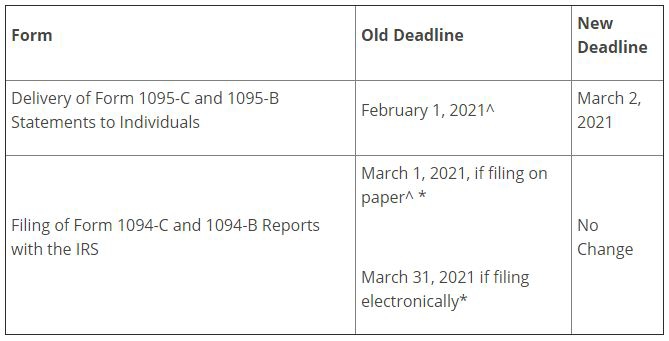

Jan 21, 21 · Form 1095C This tax form is normally sent to employees by their employer prior to January 31 each year IRS Notice 76 (page 6, paragraph A) extends the deadline to provide the form by March 2, 21 Form 1095C for federal civilian employees paid by DFAS and military members will be available on myPay NLT January 31 Forms will be mailedExtension of due date for furnishing statements The due date for furnishing Form 1095C to individuals is extended from January 31, 21, to March 2, 21 See Notice 76 and Extensions of time to furnish statements to recipients Relief for failure to furnish statements to certain employees enrolled in selfinsured health planFeb 13, 21 · The 1095C documents your health care election for Employees will only receive a 1095C from the district if you are benefit eligible The Affordable Care Act states that all employees who regularly work 30 hours or more are eligible for medical benefits

1 What is the 1095C form?Get IRS 1095C 21 Get form Show details You or your family members are eligible for certain types of minimum essential coverage, you may not be eligible for the premium tax credit If your employer provided you or a family member health coverage through an insured health plan or in another manner, you may receive information about theMar 03, 21 · The FORM 1095C EmployerProvided Health Insurance Offer and Coverage was mailed on March 1, 21 Taxpayers do not need to wait to receive Forms 1095B and 1095C before filing their returns Taxpayers may rely on other information received from their employer or other coverage provider for purposes of filing their returns

You must furnish Form 1095C to your employees by March 02, 21 The due date for filing Forms 1094C and 1095C with the IRS is February 28th, 21 if filing by paper, and March 31st, 21 if filed electronicallyThe IRS extends the Form 1095 recipient copy deadline from January 31, 21, to March 02, 21The 1095B / 1095C Forms need to be efiled with the IRS on or before March 31, 21 If you choose to file ACA Forms by paper, you must file before February 28, 21You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

What Does A 1095 C Delay Mean For 1040 Filings Integrity Data

Form 1094CThe Internal Revenue Service (IRS) issued draft 1094B, 1095B, 1094C, and 1095C forms for use by employers, plan sponsors and group health insurers to report health coverage to plan members and the IRS The IRS is providing these drafts for information purposes only Do not file using draft forms Draft instructions for all forms are still to comeFeb 16, 21 · Form 1095C Instructions 21 Kyle Edison Last Updated February 16, 21 0 1 minute read Form 1095C, Employer EmployerProvided Health Insurance Offer and Coverage is the tax form filed by employers reporting the employersponsored health coverageBy 21, IRS mandates the reporting of ICHRA on Form 1095C to the employers who offered ICHRA to their employees With an ICHRA (Individual coverage health reimbursement arrangements), an employer provides a class of employees with a monthly allowance that can be used to purchase individual health coverage from the marketplace

Accurate 1095 C Forms Reporting A Primer Integrity Data

1095 Tax Info Access Health Ct

For the Tax year, the deadline to furnish ACA Forms to the employees is extended to March 02, 21 On July 13, , the IRS released the final instructions of the Form 1095C to be used for reporting in the tax year The revised Form 1095C has a new line (Line 17, Zip Code) related to ICHRA informationApr 09, 21 · Employers should note that the March 21 enactment of the American Rescue Plan (ARP) temporarily reduces the affordability cap to no more than 85% of household income for the 21 and 22 tax years This may result in the IRS lowering the corresponding IRC Section 4980H(b) penalty threshold to 85%, instead of the current 9% for 21Feb 22, 21 · Before March 2, 21 eligible employees will receive a Form 1095C tax document, which reports information about your medical coverage in While you will not need to include your 1095C with your tax return filing, or send it to the IRS, you may need information from your 1095C to help complete your tax return

Ez1095 Software How To Print Form 1095 C And 1094 C

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Do Walmart's plans qualify as minimal essential coverage?Find us at https//wwwbernieportalcom/hrpartyofone/In , the IRS issued a few key updates to Form 1095C Now, all applicable large employers (ALEsAvoid Possible Phishing Scams via Text and Email If you were eligible for MCG benefits in , you will be provided with 1095 forms no later than early March 21 The 1095 form reports information about your healthcare coverage as required by the Affordable Care Act

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

21 Aca Reporting 1094 1095 Filing Deadline

1095C Forms Are Coming Soon 1095 Forms Will Be Mailed to You;Dec 30, · The 1095C form is the government's way of tracking this Essentially, the 1095C's function is to communicate health insurance information to the IRS What are the Acceptable Distribution Channels?Mar 02, 21 · IRS 1095C forms were sent via email on Monday, March 1, and Tuesday, March 2, to all fulltime and parttime employees who were enrolled in their benefits program during Please check your junk folder for the email as it appears the communication was delivered to that folder The email came from the address "Online Form Retrieval" with the subject "IMPORTANT

Aca Deadlines Penalties Extension For 21 Checkmark Blog

Form 1095 C Mailed On March 1 21 News Illinois State

The 1095C form provides proof of health insurance for your tax filing When you file your taxes in 21, you may need to state whether you and/or your dependents had health insurance in 2 What is "minimum essential coverage"?When the 1095C must go out Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for would be sent in January 21Form 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax return

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Oct 05, · For likely the final time, the IRS has issued Notice 76 extending by 30 days the 21 deadline to furnish the Forms 1095B and 1095C to individuals The Notice mirrors the same 30day extensions for the past four years of ACA reporting However, the IRS added this year that unless it receives "comments that explain why this relief continues to be necessary," the 30Jan 18, 15 · Form 1095C, EmployerProvided Health Insurance Offer and Coverage This form is furnished to those who had employersponsored coverage TIPmore about the reporting requirements here Employers can find out More on 1095B and C Forms 21Mar 23, 21 · Form 1095B is the catchall form that is issued for any type of coverage not on a Form 1095A or C This includes coverage from insurance companies, the government (Medicaid, CHIP, Medicare Part A, TRICARE, VA, etc), small selfinsured employers, and more

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Payroll Systems Things To Consider When Filing Forms 1095 C 1094 C Payroll Systems

Nov 07, · Form 1095C is sent out to those who enrolled in a health plan through the Health Insurance Marketplace In 21, you will be furnished with a Form 1095C reporting the information you need to know about the plan you enrolled inWho will send my Form 1095C?Mar 09, 21 · Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C

1095 C Form Official Irs Version Discount Tax Forms

Aca Code Cheatsheet

Applicable Large Employers hiring over 50 employees have to use 1095 C Form This document should contain information for employerprovided Health Insurance Offer and Coverage Every fulltime employee has to meet certain health standards For its part, every ALE should pay, record and report insurance expenses to the Internal Revenue ServiceJul 27, · The IRS released for comments a draft of Form 1095C Employers will use the final version early next year to report on health coverage in The revisions add a second page to the form and mayNov 11, · As in past years, there's some flexibility with the due date for the Form 1095C The deadline to provide the form to employees has been extended from Jan 31, 21, to March 2, 21 When submitting returns to the IRS, the deadlines are March 1, 21, if mailing the forms and March 31, 21, if they're transmitted online

Ez1095 Software How To Print Form 1095 C And 1094 C

Compliance Considerations Covid And 1095 C Reporting Hays Companies

A copy of Form 1095B or 1095C should be provided to your employees/recipients on or before March 02, 21 Paper Filing Deadline If you prefer to paper file your ACA forms, then you have to file it with the IRS on or before February 28, 21Fulltime equivalent employees of ALEs should receive Form 1095C from their employer When will I receive Form 1095C?Use the information from your 1095A to "reconcile" Once you have an accurate 1095A and second lowest cost Silver plan premium, you're ready to fill out Form 62, Premium Tax Credit See a stepbystep guide to reconciling your premium tax credit More Answers Form 1095A

1095 18 Fill Out And Sign Printable Pdf Template Signnow

Form 1095 C Guide For Employees Contact Us

The deadlines for filing Form 1095C with the IRS and furnishing copies to the recipient are as follows March 2, 21, is the deadline to distribute recipient copies March 1, 21, is the deadline to paper file Forms 1095C with the IRS March 31, 21, is the deadline to efile Forms 1095C with the IRS Click here to learn more about ACA deadlines for 21Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1096 Annual Summary and Transmittal of US Information Returns (Info Copy Only) 21 Form 1098C Contributions of Motor Vehicles, Boats, and Airplanes (Info Copy Only) 19 10/30/19 Form 1098C Contributions of Motor Vehicles, Boats, andMar 02, 21 · IRS Form 1095 C Information Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you by March 2, 21

Your 1095 C Obligations Explained

Deadlines For 1095 Cs 1095 Bs In 21 Bernieportal

EmployerProvided Health Insurance Form 1095C There is no longer a federal mandate to have health insurance and you do not have to file Form 1095C on your Tax return Prepare and eFile Your Taxes here on eFilecom 1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21Form 1095C, you must be aware of Section 4980H safe harbor and Offer of coverage codes States Form to File Deadlines California IRS 1094 & 1095B/C Form Distribution to Employees February 01, 21 State Filing March 31, 21 District of Columbia IRS 1094 & 1095B/C Form Distribution to Employees March 02, 21 State Filing April 30, 21Form 1095C for each employee who was a fulltime employee of the ALE Member for any month of the calendar year Generally, the ALE Member is required to furnish a copy of the Form 1095C (or a substitute form) to the employee An ALE Member is, generally, a single person or entity that is

Changes Coming For 1095 C Form Tango Health Tango Health

Aca Processing 1095 B 1095 C

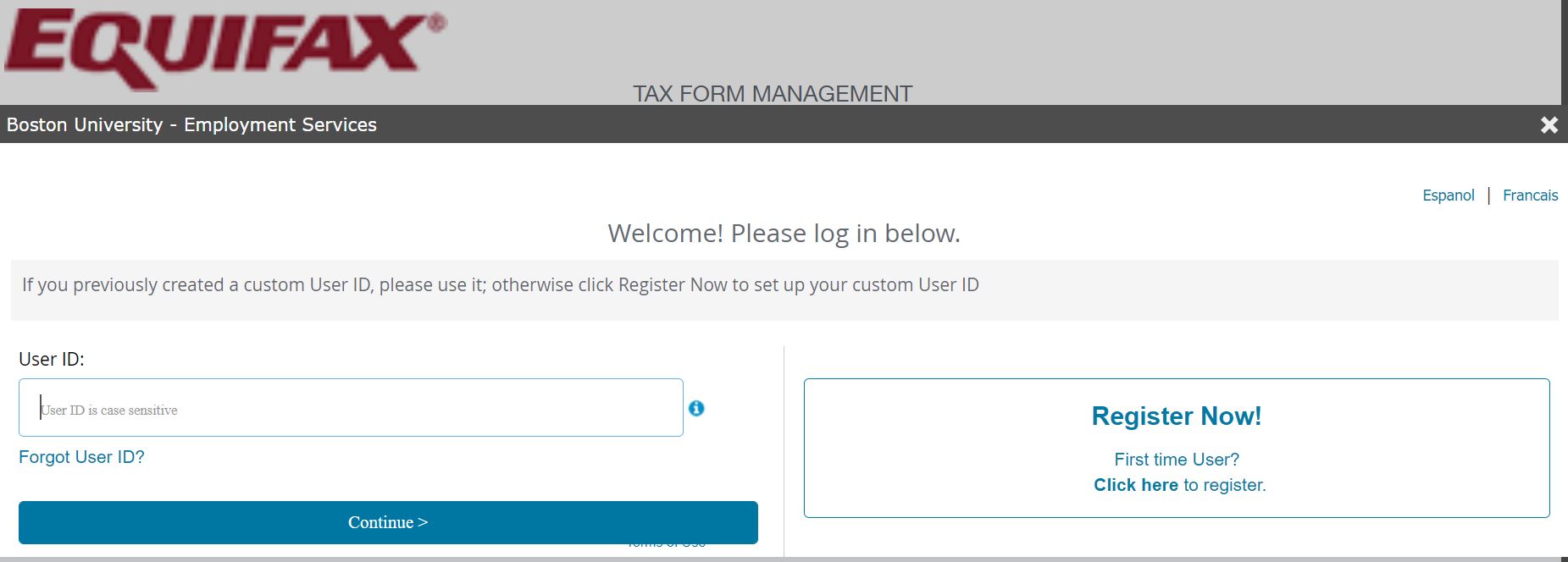

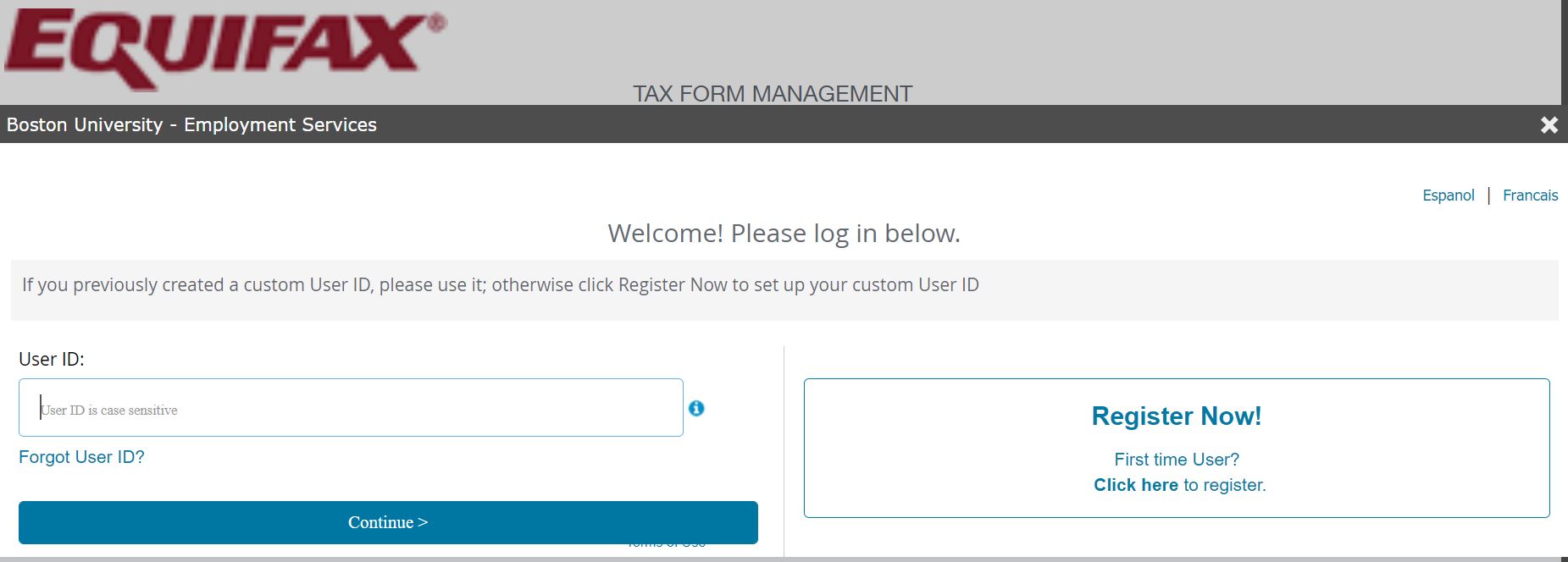

Employers are required to send Form 1095C for the tax year by March 2, 21 What should I do if I don't receive a Form 1095C or if I lose my form?Feb 09, 21 · You may also obtain a copy of your form by logging into myPay If you have questions about the information on your IRS Form 1095C, or about lost or incorrect forms, you must contact the telephone number provided on your IRS Form 1095C in box #10 The telephone number is 7411

News 1095 C Tax Form Coming Soon

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Looking For Your Form 1095 C Bethel University

Updates To Form 1095 C For Filing In 21 Youtube

Deadlines Ahead As Employers Prep For Aca Reporting In 21

Form 1095 C H R Block

1095 C Print Mail s

Aca Code Cheatsheet

Irs Distribution Deadline March 2 21 Aca Gps

Irs Form 1095 C Codes Explained Integrity Data

Accurate 1095 C Forms Reporting A Primer Integrity Data

Irs Extends Deadline For Furnishing Form 1095 C To Employees Extends Good Faith Transition Relief For The Final Time Hmk

Your 1095 C Tax Form For Human Resources

Need A Duplicate W 2 Or 1095 C Authorize Web Delivery Of Your Tax Forms Montgomery County Public Schools

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Form 1095 C Forms Human Resources Vanderbilt University

Form 1095 C To Arrive In February University Of Pennsylvania Almanac

Form 1095 C Now Available Online At My Vu Benefits Vanderbilt News Vanderbilt University

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Your 1095 C Obligations Explained

Employer Reporting Forms 1094 C And 1095 C Hays Companies

Irs Form 1095 C Codes Explained Integrity Data

What Are The Differences Between Form 1095 A 1095 B And 1095 C

Irs Update Regarding The Aca Here S How To Avoid Penalties Big Irs News Concerning Aca Deadlines

Changes Coming For 1095 C Form Tango Health Tango Health

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

How To Obtain W 2 1095 C Statements Postal Times

1095 C Faqs Mass Gov

Updates To Form 1095 C For Filing In 21 Youtube

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 C Form 21 Irs Forms Zrivo

Form 1095 A 1095 B 1095 C And Instructions

Form 1094 C And Form 1095 C B Benchmark Planning Group

Aca And The Vista Hrms Fall Update

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

Irs Updates To New Form 1094 C And 1095 C Drafts Bernieportal

Trisure Corporation Legal Alert Irs Extends Deadline For Furnishing Form 1095 C To Employees Facebook

New Tax Forms For Fehb Enrollees Forms 1095

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Irs Extends Distribution Time Limit For Form 1095 Anderson Jones

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Irs Form 1095 C To Be Distributed Hub

Ivvctl6 Rx46gm

Irs Form 1095 C Uva Hr

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Annual Health Care Coverage Statements

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Changes In Irs Form 1095 C For Taxbandits Youtube

Guide To Form 1095 H R Block

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Form 21 Irs Forms

What Is Form 1095 C Acawise Youtube

E File Aca Form 1095 C Online How To File 1095 C For

Where Do I Find My 1095 Tax Form Healthinsurance Org

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

Affordable Care Act Deadlines Extended For Notices Lexology

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Irs Form 1095 C Fauquier County Va

21 Aca Code Cheatsheet Download Our Free Guide

What Is Form 1095 C And Why Did I Receive It In The Mail From The Irs

Changes In 21 Aca Reporting Health Insurance Coverage Employment How To Plan

1095 C Sample Hcm 401 K Human Resources

Finally Some Good News California S Franchise Tax Board Delays Individual Mandate Reporting And Disclosure Deadlines

Non Full Time Employees May Request A Copy Of Form 1095 C Uncsa

0 件のコメント:

コメントを投稿